First, a review of last week’s events:

- EUR/USD. Since it is not only the pound that depends on what happens in the framework of Brexit, but also the Euro, to begin with, we will tell you what the situation looks like with the UK's exit from the EU a week before this exit (if it happens of course). And the situation looks like... a vicious circle.

On the one hand, Prime Minister Boris Johnson refuses to withdraw his draft EU withdrawal Agreement until Parliament agrees to an election on December 12. But the Parliament does not agree, because the opposition wants Johnson to rule out the option of leaving without an Agreement with the EU, as well as for the EU to agree to an extension of the terms of this exit. The EU, for its part, before deciding on how long to extend Brexit, is waiting for the consent (or disagreement) of Parliament for early elections on December 12.

Is everything clear? Or not? Judging by the reaction of the markets, it is difficult to understand the current situation, but it is even more difficult to make any predictions. That is why we did not see any significant jumps in quotations last week. The Euro weakened slightly against the dollar, but this fall was only 100 points, and the pair ended the five-day session at 1.1080.

In addition to the endless uncertainty with Brexit, additional pressure on the Euro is certainly exerted by the slowing European economy. Despite the efforts of the ECB, inflation can not reach the target level of 2%. In September, the European regulator lowered its key interest rate to negative -0.5% and announced its intention to resume the program of quantitative easing (QE). On October 31, the current head of the ECB leaves his post, and it is possible that with the arrival of the new head, Christine Lagarde, the policy of the European Central Bank will undergo some changes. But at the moment, from the point of view of investors, the advantage is on the side of the dollar, as the US Federal Reserve rate is positive and is 2%; - GBP/USD. So, instead of bringing clarity, the vote on the terms of Brexit in the UK Parliament on October 19 confused the situation even more. As a result, "super Saturday" did not lead to super jumps in the financial markets, but caused only a smooth decline in the British currency by about 200 points, returning the quotes to the levels of seven days ago, to the 1.2825 zone;

- USD/JPY. Giving a forecast for this pair the previous week, we noted a complete confusion and discord among both analysts and technical analysis tools. It seems that speculators have lost interest in the Japanese currency for a while, as a result, the pair moved in the corridor 108.45-108.75 most of the time. Two attempts of the bears to reverse the situation can not be taken into account, as the pair very quickly returned to this super-narrow channel, only 30 points wide, closer to the upper border of which it put the final point, freezing at 108.65;

- cryptocurrencies. As one analyst put it, the head of Facebook "hammered the last nail into the lid of the cryptocurrency coffin" last week. More precisely, Zuckerberg and congressmen hammered it together during his appearance before the House of Representatives Financial Service Committee. Congressmen have not only expressed concern about the spread of cryptocurrencies in general and the Libra project in particular. They said cryptocurrencies pose a threat to the traditional currency market and could be used to finance criminal activity and money laundering. But this is not all: during the hearings, a proposal was made to think about a bill on a complete ban of cryptocurrencies.

As for Mark Zuckerberg, he said that Libra will not be launched until it receives the permission of the regulator. And in general, according to him, Libra is a risky project, and he, Zuckerberg, is not at all sure that this initiative of his is able to bring him profit.

Recall that shortly before, against the background of problems with the American legislation, Telegram "turned on the back speed" and postponed the launch of its TON cryptocurrency.

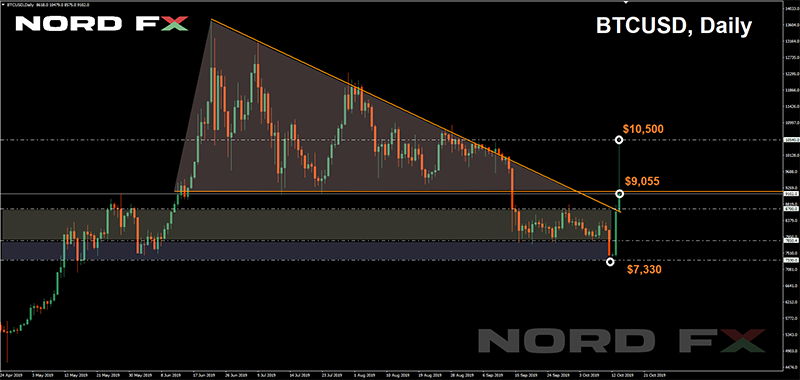

We have repeatedly written that the crypto market depends on the news background as much as possible. And the news from the US Congress led to the fact that on Wednesday October 23, the benchmark currency collapsed to a five-month low, shrinking by almost $1,000 in a day, and reaching the bottom at $7.330.

But the crypto surprises did not end there, and it turned out that it was too early to bury this market. On Friday, October 25, the market literally exploded, and the bitcoin exchange rate made an incredible jump of $3,000, adding a maximum of 40% and reaching $10,500.

This was the largest increase since February 2014., and it was caused by news again: that Chinese President XI Jinping supported the development of blockchain. At the same time, the editorial of the Chinese newspaper People's Daily, which reported on this statement, doesn't have a word about bitcoin or cryptocurrencies in general, but the bulls did not need them.

Following bitcoin, almost all altcoins from the TOP 100 went up. Ethereum (ETH/USD) jumped almost 30%, ripple (XRP/USD) – 31%, litecoin (LTC/USD) – 35%.

As a result, coin owners and traders who have already opened long positions on bitcoin and other cryptocurrencies were able to get a very significant profit. Those who "jumped into the last car of the departing train" suffered no less significant losses: the BTC/USD pair turned around very quickly and collapsed to the level of $9,055 – a powerful support on which it relied since mid-June.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Some analysts believe that the coming week may be the "hottest" this year. In addition to the fact that the UK may leave the European Union on Thursday, October 31, the day before, on Wednesday, the US Federal Reserve may lower the interest rate on the dollar from 2.0% to 1.75%. It seems that the head of the Federal Reserve Jerome Powell has succumbed to the exhortations of President Trump. His office has already launched a $60 billion monthly asset purchase program In October, and now here is another step toward stimulating the American real sector. Powell does not want to call what is happening a quantitative easening (QE) for some reason, but perhaps he is right: a number of experts believe that there is just another emission of the dollar mass and pumping the economy with unsecured money. With a certain degree of probability, this is due to the upcoming presidential elections in the United States. And Trump, who is seeking re-election to the second term, is pressing the Fed to cut the rate further, down to zero.

Shortly before the Fed meeting, on October 30, preliminary data on US GDP will be known and, according to forecasts, it will show a slowdown in the economic growth in the III quarter from 2.0% to 1.6%. If so, Trump will get another lever of pressure on Powell and the Fed led by him.

As for other events of the coming week, it is worth noting the preliminary estimate of the GDP growth and inflation data in the Eurozone, which will be known on Thursday 31 October. Data on the US labor market (including NFP) and the business activity index from ISM will traditionally be released on Friday, November 01.

Summing up the forecasts of experts for the coming week, it has not been possible to form any definite opinion: 50% are for the fall of the pair, 50% are for its growth. A similar discrepancy is observed in the readings of indicators on D1. This is due to uncertainty and the decision of the Federal Reserve on the interest rate, and with the exit/non-exit of Britain from the EU.

It should be noted that even if there is no exit without a deal and Brexit gets a delay, it can still have a negative impact on the Euro exchange rate, as a result of which the pair will rush to the minimum of October 01 in the area of 1.0880, which can be reached during November. 70% of experts agree with this forecast. The main supports are located at 1.1065, 1.1000 and 1.0940 levels.

The signing of the agreement with the EU, supported by the UK Parliament, will push the pair up into the 1.1350-1.1400 zone. Resistances are at 1.1180, 1.1240 and 1.1300; - GBP/USD. Most experts (60%) do not expect anything good for the pound in the near future. In full agreement with the graphical analysis on D1 and 80% of the indicators on H4, they are waiting for the pair to fall to the level of 1.2500. Supports are 1.2770 and 1.2580.

On the other hand, 20% of oscillators on H4 already give signals the pair is oversold, and 90% of their "colleagues" on D1 are painted green. 85% of trend indicators on D1 are looking to the north as well, the target is the height of 1.3200.

There were only 30% of experts in the list of "green activists" this week. The remaining 10% refused to give any forecasts and, perhaps, they are right: British politicians are able to turn any arguments, calculations and forecasts to dust; - USD/JPY. In theory, the targets for the yen have remained unchanged. Support zones are 107.00, 106.65 and 105.70, those of resistance are109.00 and 109.85. But this is in theory. In reality, long-term bonds, with which the Japanese currency is strongly correlated, remain squeezed in a narrow range, curbing the risk appetite of investors. Of course, the above events of the week, as well as the decision of the Bank of Japan on the interest rate on Thursday 31 October could fuel interest in the yen, but this is again in theory. With almost 100% probability, the regulator will leave the interest rate unchanged at -0.1%.

Interestingly, analysts at J. P. Morgan Chase believe negative Central Bank rates are a "bad idea" that only prevents economies from emerging from recession. 80% of the surveyed experts agree with them, expecting that the yen will continue to fall, the pair will finally break through the upper limit of the corridor 108.45-108.75 and rise a little further to the north. But the graphical analysis on H4 predicts the continuation of this sideways trend at least for the first half of the week; - cryptocurrencies. So, during the week, the BTC/USD pair first rapidly lost $1,000 in price, then even more rapidly rose by $3,000, and then collapsed again, shrinking in price by $1,445. Trying to give any forecast in the conditions of such volatility is a thankless task. Focusing on technical analysis tools is generally useless. It is necessary to give the market the opportunity to calm down a little and understand what the Chinese President really meant.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Повернутися Повернутися