EUR/USD: Awaiting Fed and ECB Meetings

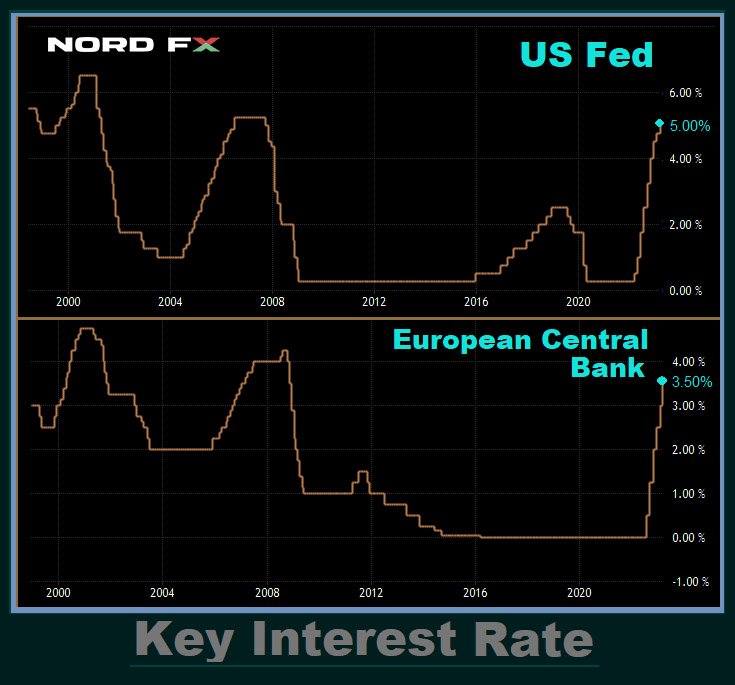

- The main factor determining the dynamics of the US Dollar Index (DXY) and, consequently, the EUR/USD pair last week was… silence. If recently, the speeches of Federal Reserve representatives were almost the most important market guide, then a silence regime has been in effect since April 21. Leading up to the press conference by Fed Chairman Jerome Powell following the FOMC's May meeting, all officials are instructed to maintain silence. Only a few days remain until the FOMC (Federal Open Market Committee) meeting, where a decision regarding the regulator's future monetary policy will be made, scheduled for May 2/3. Furthermore, on Thursday, May 4, there will be a meeting of the European Central Bank, where an interest rate decision will also be made. In general, the upcoming five-day period promises to be, at the very least, not dull.

Of course, macroeconomic data and events from both sides of the Atlantic caused certain fluctuations in EUR/USD last week. However, the final result was close to zero: if on Friday, May 21, the last chord sounded at the 1.0988 mark, then on Friday, May 28, it was placed not far away: at the 1.1015 level.

One event worth highlighting was the publication of the First Republic Bank (FRC) report, which ranks among the top 30 US banks by market capitalization. It was this report that led to the dollar's decline and the pair's surge by more than 100 points on Wednesday, April 26.

It seemed that the banking crisis caused by the tightening of the Federal Reserve's monetary policy (QT) was beginning to fade... US Treasury Secretary Janet Yellen even assured the public of the resilience of the banking sector. But then... a new flare-up called First Republic Bank (FRC). To prevent its bankruptcy and support its liquidity in Q1 2023, a consortium of banks transferred $30 billion in uninsured deposits to FRC. Another $70 billion in the form of credit was provided by JPMorgan. However, this was not enough: the bank's clients began to scatter, and FRC shares collapsed by 45% in two days and by 95% since the beginning of the year. In March alone, clients withdrew $100 billion from the bank. Thus, First Republic Bank has a very high chance of becoming number 4 in the lineup of bankrupted major US banks. And if the Fed does not stop its QT cycle, there is a very high probability that numbers 5, 6, 7, and so on will appear on this list.

However, as we have already detailed in our previous review, at the meeting on May 2/3, the key rate will be raised by only 25 basis points (FedWatch from CME estimates the probability of this at 72%). After that, the US Central bank is likely to take a pause. As stated by the President of the Federal Reserve Bank of Atlanta, Raphael Bostic, "one more increase should be enough for us to step back and see how our policy is reflected in the economy." It should be noted that the 25 bp rate hike has long been factored into market quotations. Therefore, immediately after the news about FRC and the surge to 1.1095, EUR/USD returned to a comfortable state for itself.

At the time of writing the review, on Friday evening, April 28, analysts' opinions were divided as follows: 35% of them expect the dollar to weaken and the pair to rise, 50% expect it to strengthen, and the remaining 15% have taken a neutral position. As for technical analysis, among oscillators on D1, 85% are coloured green, 15% are neutral-grey, among trend indicators, 90% are green, and 10% have changed to red. The nearest support for the pair is located in the area of 1.0985-1.1000, followed by 1.0925-1.0955, 1.0865-1.0885, 1.0740-1.0760, 1.0675-1.0710, 1.0620, and 1.0490-1.0530. Bulls will encounter resistance in the area of 1.1050-1.1070, then 1.1110, 1.1230, 1.1280, and 1.1355-1.1390.

In addition to the aforementioned FOMC and ECB meetings, we can expect a substantial amount of economic data next week. On Monday, May 1, the ISM Manufacturing PMI for the US will be published. The next day, the value of a similar index, but for Germany, will become known. Also, on Tuesday, May 2, we will learn about the inflation situation in the Eurozone, as the Consumer Price Index (CPI) will be released. Furthermore, on May 2, 3, 4, and 5, we will get a flurry of US labour market data. Important indicators such as the unemployment rate and the number of new non-farm jobs in the US (NFP) are among these, they will traditionally be published on the first Friday of the month, May 5.

GBP/USD: BoE vs. Fed: Who Will Win the Battle of Interest Rates?

- The Bank of England (BoE) meeting will take place a week after the Fed's meeting, on Thursday, May 11. Most experts believe that the cycle of interest rate hikes for the pound is not yet over, which supports the British currency.

Recent data on inflation for March contribute to these forecasts. The Consumer Price Index (CPI) in annual terms once again reached a double-digit figure, 10.1%, which is higher than the forecast of 9.8%. To bring this indicator below the psychologically important mark of 10.0%, the BoE is highly likely to continue following the Fed's example. Market participants expect the regulator to raise the interest rate by 50 basis points on May 11: from 4.25% to 4.75%. No more effective ways to curb inflation have been devised so far. And if it continues to remain so high, it will harm both the consumer market and the overall UK economy.

Since the beginning of April, we have observed a sideways trend. However, GBP/USD finished the past five-day period at the 1.2566 mark, unexpectedly breaking the upper boundary of the channel. Perhaps the reason for the jump was the closing of trading positions at the end of the month. Currently, 75% of experts are in favor of the dollar, and only 25% side with the British pound. Among oscillators on D1, the balance of power is as follows: 85% vote in favor of the green (with a third of them being in the overbought zone), and the remaining 15% have turned neutral-grey. Trend indicators are 100% on the green side. Support levels and zones for the pair are 1.2450-1.2480, 1.2390-1.2400, 1.2330, 1.2275, 1.2200, 1.2145, 1.2075-1.2085, 1.2000-1.2025, 1.1960, 1.1900-1.1920, and 1.1800-1.1840. As the pair moves north, it will encounter resistance at the levels of 1.2510-1.2540, 1.2575-1.2610, 1.2700, 1.2820, and 1.2940.

Regarding important statistics on the state of the UK economy for the upcoming week, on Tuesday, May 2, the Manufacturing Purchasing Managers' Index (PMI) will be published. Then, on May 4, we will learn the value of the PMI for the services sector as well as the composite business activity indicator for the UK as a whole. Traders should also be aware that there will be a bank holiday in the country on Monday, May 1.

USD/JPY: Bank of Japan - Heading for Softer Ultra-Soft Policy

- Forecasting the interest rate of the Bank of Japan (BoJ) is quite simple and very, very boring. As a reminder, it is currently at a negative level of -0.1% and was last changed on January 29 of the distant 2016, when it was lowered by 20 basis points. This time around, at its meeting on Friday, April 28, the regulator left it unchanged at the same -0.1%.

But that's not all. Many market participants were expecting that with the arrival of the new Central bank governor, Kazuo Ueda, the regulator would eventually change course towards tightening. However, contrary to these expectations, during his first press conference following his first meeting on April 28, Ueda stated, "We will continue to ease monetary policy without hesitation if necessary." One might wonder how much softer it could get, but it turns out that the current -0.1% is not the limit.

The result of the BoJ governor's words can be seen on the chart: in just a few hours, USD/JPY soared from 133.30 to 136.55, weakening the yen by 325 points. Of course, it's still far from the October 2022 peak, but a rise to the 137.50 level no longer seems entirely unrealistic.

The pair ended the past week at the level of 136.30. Regarding its near-term prospects, analysts' opinions are distributed as follows: currently, only 25% of experts vote for the pair's further growth, 65% point in the opposite direction, expecting the yen to strengthen, and 10% simply shrug. Among the oscillators on D1, 85% point upward (a third of them are in the overbought zone), while the remaining 15% remain neutral. Trend indicators show 90% looking north, and 10% pointing south. The nearest support level is in the 136.00 area. Next are the levels and zones at 135.60, 134.75-135.15, 132.80-133.00, 132.00-132.40, 131.25, 130.50-130.60, 129.65, 128.00-128.15, and 127.20. Resistance levels and zones are at 137.50 and 137.90-138.00, 139.05, and 140.60.

Regarding events characterizing the state of the Japanese economy, none are expected in the coming week. Moreover, the country is looking forward to a series of holidays: May 3 is Constitution Day, May 4 - Greenery Day, and May 5 is Children's Day. As a result, the dynamics of USD/JPY will depend entirely on what is happening on the other side of the Pacific Ocean, in the United States.

CRYPTOCURRENCIES: Awaiting the 2024 Halving

- BTC/USD continued to decline on Monday, April 24 and, after breaking the support at $27,000, fell to $26,933. Market participants were already prepared to see bitcoin go even lower at the strong support level of $26,500. However, it unexpectedly soared to $30,020 on April 26. The main cryptocurrency was saved, as it has been many times before and will be many times again, by a weakened dollar. The cause of the shock was the problems of First Republic Bank, which followed a series of bankruptcies of crypto-friendly banks, as discussed above.

The correlation between the crypto and banking industries arises thanks to the following chain of events: 1) Tightening of the Federal Reserve's monetary policy hits banks, lowering their asset prices, reducing demand for their services, and causing customers to flee. 2) This situation creates serious difficulties for some banks and leads to the bankruptcy of others. 3) This can force the Fed to pause its cycle of raising interest rates or even lower them. Additionally, the regulator may restart the printing press to support bank liquidity. 4) Low rates and a flow of new cheap money lead to a decrease in the value of the dollar and allow investors to direct these funds into risky assets such as stocks and cryptocurrencies, which leads to an increase in their quotes. We have already seen this during the COVID-19 pandemic and may see it again in the near future.

According to former Goldman Sachs top manager and macro-investor Raoul Pal, the Federal Reserve (Fed) is likely to have finished its saga of raising interest rates. He has also predicted an upcoming recession that will force the regulator to "change course" and support the markets by printing money. In that case, he believes that risky assets are in for an "inevitable liquidity wave." This capital influx will "enlighten" the crypto industry with new innovations, and the number of people using digital assets will increase from the current 300 million to over 1 billion.

According to experts from the British bank Standard Chartered, bitcoin has benefited from its status as a "brand refuge" for savings at the beginning of 2023, and the current situation indicates the end of the "crypto winter". Standard Chartered believes that recent turmoil in the banking sector, stabilization of risky assets due to the end of the Fed's interest rate hike cycle, and increased profitability in the crypto mining industry will contribute to BTC's further growth. In addition, the adoption of the first EU framework for regulating crypto markets by the European Parliament could also support the leading cryptocurrency. The upcoming halving event will also impact BTC's growth, with bitcoin potentially reaching $100,000 by the end of 2024.

It should be noted that the topic of halving is becoming more and more prevalent. The Bitcoin Archive press service reminds us that it is less than a year away, with the procedure scheduled for April 6, 2024, as of April 24, 2023. However, this date is not final and may change, as it has in the past.

Some market participants believe that this event will be crucial for the future price of the flagship cryptocurrency. They believe that cycles for cryptocurrencies are consistent, and BTC quotes will reach new record highs a year or a year and a half after halving, as happened in previous cycles. Others argue that the market situation has changed. Bitcoin has become a mass phenomenon, and now "other laws and rules apply to the cryptocurrency", so other factors will become decisive, not just the halving of mining rewards.

It is worth noting that the second group of specialists includes Bloomberg Intelligence analyst Jamie Coutts, who predicts that the price of bitcoin will rise to $50,000 before April 2024. "The price of bitcoin bottoms out when there are 12-18 months left until the halving. The structure of the current cycle is similar to previous ones. However, many factors have changed: the network has become significantly more resilient, and bitcoin has never experienced a prolonged economic downturn," Coutts said. If his forecast is correct, the asset will appreciate by about 220% from the low reached last November before the halving.

The expert and trader known as Doctor Profit reminded of his previous statement that the bottom for bitcoin was reached at the level of $15,400, and it is unlikely that we will see another drop to this level. The dump in November 2022 was a complete capitulation, including for bitcoin miners, some of whom were forced to sell their coins and equipment at a loss. According to Doctor Profit, BTC is currently in an accumulation phase, neither in a bull nor in a bear market. At the same time, the specialist has advised traders to closely monitor the correlation between the Chinese stock market and bitcoin, believing that China will lift the ban on cryptocurrencies and legalize them, which will have a very positive long-term effect on their price.

Another analyst under the nickname DonAlt also excludes a drop in BTC/USD to the lows of November 2022. At the same time, he allows for a correction down to $20,000, which, in his opinion, will be a good level to replenish the reserves of the main cryptocurrency.

It's been a while since we quoted the popular analyst under the nickname PlanB, known for his Stock-to-Flow (S2F) model. He continues to assert that the predictions he makes based on this model continue to come true. "Before the halving, we can expect $32,000 for bitcoin, then $60,000. Then [after the halving] $100,000 will become the minimum, and the maximum rate could reach $1 million. But on average, after the next halving, the BTC rate should reach $542,000," wrote PlanB. At the same time, the analyst emphasized that the behaviour of the crypto market fully corresponds to S2F, so its critics are simply unfounded.

It is worth noting that PlanB is not alone in his super-optimistic predictions for the price of bitcoin, which legendary Warren Buffett called "rat poison squared." Robert Kiyosaki, the author of the popular book Rich Dad Poor Dad, believes that the value of the flagship cryptocurrency will rise to $500,000 by 2025. And at Ark Invest, looking a decade ahead, they named a figure of $1 million per coin.

As of the evening of Friday, April 28, BTC/USD is trading at $29,345. The total market capitalization of the crypto market is $1.205 trillion ($1.153 trillion a week ago). The Crypto Fear & Greed Index has increased from 50 to 64 points over the past seven days, moving from Neutral to the Greed zone.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back